We may have a beneficial long/short position in some of the shares mentioned via stock ownership, options, or other derivatives.

This presentation expresses the opinion of the author and is provided for informational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities.

The material is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations.

In this post we’re going to provide our Q2 ‘25 earnings preview for 7 crude tankers companies we cover. The companies covered are:

Teekay Tankers (TNK)

DHT Holdings (DHT)

Okeanis Eco Tankers (ECO and OET.OL)

Frontline (FRO and FRO.OL)

Nordic American Tankers (NAT)

International Seaways (INSW)

Taskos Energy Navigation (TEN)

The EPS estimates are adjusted/normalized earnings and do not account for extraordinary items like sale of ships, etc.

Data is as of 14th July 2025 and average street analysts’ estimates are taken from Yahoo Finance/MarketWatch.

According to the Baltic Exchange spot TCE rates on standard vessels (i.e. non-Eco and non-scrubber) have averaged $41,400 for VLCCs, $43,500 for Suezmaxes and $37,000 for Aframaxes in Q2 ‘25.

Despite the analysts’ narrative of an upcoming supercycle due to increasing sanctions on Iran, imminent stop to Iranian exports, OPEC production hikes, sanctions on Russia, the unseaworthiness of the dark fleet and the upcoming scrapping “wall” in front of us, rates have continued to disappoint.

Expanding on the above, rates are at healthy levels (historically speaking), but the issue “we have” is that equities’ valuations, mainly because of the above narratives (which in our view do not have too many merits), have remained inflated.

Having said this, we believe we’re entering more interesting times with OPEC incremental barrels starting to hit the water, a harder Trump’s stance on Russia, continued tension between Israel and Iran, etc.

We assessed spot Q2 ‘25 TCE rates on standard vessels (i.e. non-Eco and non-scrubber) at $37,400 for VLCCs and Suezmax, while $42,300 for Aframax.

Looking at equities, they all jumped during the Israel-Iran war in June but, by quarter end, they had given up most of their gains. Worth noting the underperformance of Okeanis Eco Tankers vs Frontline and others.

Since the start of Q3 ‘25, renewed optimism around OPEC output hikes and harsher sanctions against Russia/Iran pushed all equities higher, with Frontline being the best performer at +14% and Tsakos the worse at +2.4%.

Currently there are many moving pieces and potential uncertainties for crude tankers, including the trade war, Iran negotiations, OPEC+ returning barrels into the market, etc.

As such, it is very difficult to have a clear view on where future rates may be. Nevertheless, we have used the below assumptions for the coming quarters.

We project rates for the next 3 quarters (non-Eco, non-scrubber) at $45,000 for VLCCs, $38,300 for Suezmaxes and $36,700 for Aframaxes.

The forward looking figures in the table are based on the above rates assumptions.

Compared to last quarter, equities have become more expensive on a P/NAV basis, but if we look at earnings/FCF potential, we can see how valuations have remained stable.

Tsakos and Teekay continue to remain the companies that provide the highest Lev. FCF yield and they are also the cheapest companies from a P/NAV perspective.

At the other end of the spectrum there are DHT, Frontline and Okeanis, which are all trading at 1.00-1.10 P/NAV.

Below a P/E sensitivity analysis at various levels of achieved spot rates (not index rates).

Teekay Tankers

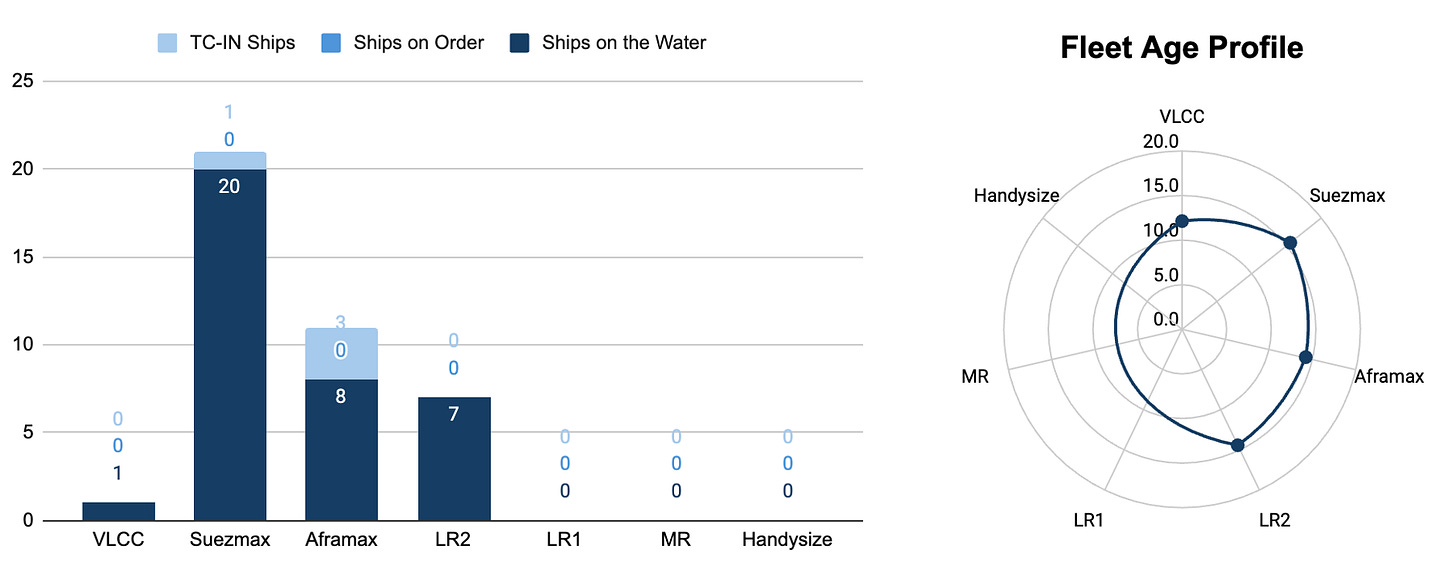

Teekay has a fleet of 36 ships on the water (+4 TC-in), with an average age of 14.9 years. The fleet is composed by 1 VLCC (owned 50%), 20 Suezmaxes (+1 TC-in) and 15 Aframaxes/LR2s (+3 TC-in).

The company should have also taken delivery of a recently acquired LR2 during Q2 ‘25.

Teekay’s Suezmaxes have an average age of 15.5 years, while the Aframaxes/LR2s of 15.1 years. The 50% owned VLCC is 12.1 years old.

The vessels are all non-Eco and do not have scrubbers installed, other than the recent secondhand purchase (i.e. Orchid Spirit).

Looking at Q2 ‘25 estimates, we expect Teekay to record EPS of ca. $1.58, below Street analysts at $1.94.

The company has a fixed dividend policy of $0.25 per quarter and we would not expect that to change.

The big question with Teekay Tankers is what is the plan for the future? With an aging fleet (19 vessels are 15yrs of age or more) and the sales of older vessels in the past quarters, fleet renewal is becoming more pressing; will they order newbuilds? Will they continue to dispose ships and replace them with secondhand modern tonnage? Will this in anyway delay any returns to shareholders?

DHT Holdings

As of end of Q1 ‘25, DHT had a fleet of 23 ships on the water (+4 newbuildings with delivery in 2026), with an average age of 11.3 years. DHT is a pure-play on the VLCC segment.

To be noted that the company should have delivered to their new owners the DHT Peony and DHT Lotus, its only Chinese-built VLCCs.

The vessels are all scrubber fitted, with ca. 43.5% of the fleet being also Eco-design.

Looking at Q2 ‘25 estimates, we expect DHT to record EPS of ca. $0.21, slightly below Street analysts at $0.26. The company has a dividend policy of distributing 100% of Adj. Net Income, so we’d expect the dividend to be equal to $0.21.

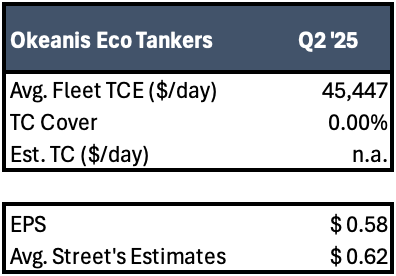

Okeanis Eco Tankers

Okeanis Eco Tankers has a fleet of 14 ships on the water, with an average age of just 5.9 years. The fleet is composed by 8 VLCC and 6 Suezmaxes.

Okeanis VLCCs have an average age of 5.3 years, while the Suezmaxes of 6.9 years.

The vessels are all Eco-design and have scrubbers installed.

Looking at Q2 ‘25 estimates, we expect Okeanis to record EPS of ca. $0.58, slightly below Street analysts at $0.62. We expect the company to distribute ca. 100% of Adj. Net Income, which would equate to $0.55-0.60.

Frontline

Frontline has a fleet of 81 ships on the water, with an average age of 7.1 years. The fleet is composed by 41 VLCCs, 22 Suezmaxes and 18 Aframaxes/LR2s.

Frontline’s VLCCs have an average age of 6.5 years, while the Suezmaxes and Aframaxes/LR2s of 7.9 and 7.7 years, respectively.

79% of the fleet can be considered Eco, and 56% of the vessels are scrubber fitted. We expect that, over time, all acquired ex-Euronav VLCCs will be fitted with scrubbers.

Looking at Q2 ‘25 estimates, we expect Frontline to record EPS of ca. $0.41, slightly below Street analysts at $0.53. We expect the company to distribute the majority of Adj. Net Income, translating into a dividend of ca. $0.35-0.40.

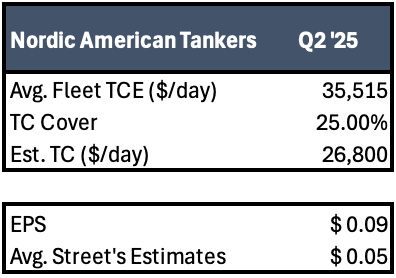

Nordic American Tankers

As at the end of Q1 ‘25, Nordic American Tankers has a fleet of 19 ships on the water, with an average age of 13.2 years. Nordic American Tankers is a pure-play on the Suezmax segment.

The company should have delivered the Nordic Castor (2004-built) to her new owners during the quarter, while also having taken delivery of the Nordic Galaxy and Nordic Moon (both 2016-built and scrubber fitted).

The vessels do not have scrubbers and ca. 42% of the fleet has an Eco-design. Worth noting that 5 vessels are >20 years of age, and we expect that the company will sell them in the coming quarters, while replacing them with more modern tonnage.

Looking at Q2 ‘25 estimates, we expect Nordic American Tankers to record EPS of ca. $0.09, slightly above Street analysts at $0.05. The company doesn’t have a fixed dividend policy, but we’d expect the dividend to be in the $0.05-0.10 range.

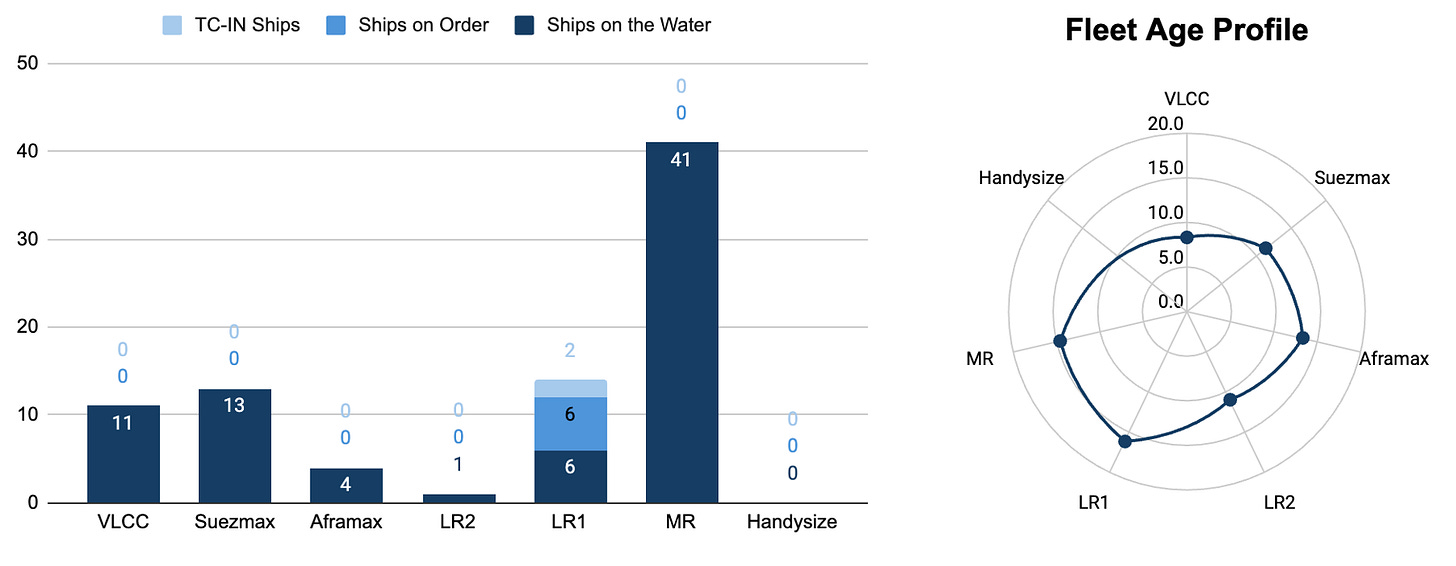

International Seaways

International Seaways has a mixed crude/product tanker fleet of 76 ships on the water (+2 TC-in and 6 newbuildings with deliveries in 2025 and 2026), with an average age of 13.1 years.

The fleet is composed by 11 VLCCs, 13 Suezmaxes, 5 Aframaxes/LR2s, 6 LR1s (+2 TC-in and 6 newbuildings) and 41 MRs.

International Seaways’ VLCCs have an average age of 8.3 years, the Suezmaxes of 11.3 years, the Aframaxes/LR2s of 12.9, the LR1s of 16.1 years and the MRs of 14.6 years.

Only 11.8% of the fleet has an Eco design and 26.3% is scrubber-fitted.

Looking at Q2 ‘25 estimates, we expect International Seaways to record EPS of ca. $1.01, slightly below Street analysts at $1.07.

Historically, the company has been distributing ca. 50.55% ofAdj. Net Income, hence we’d expect a total dividend of ca. $0.60. However, the payout was 75% in the last quarter, so it will be interesting to see if this level is maintained (it would translate into a $0.75 dividend).

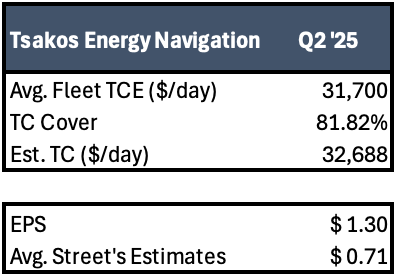

Tsakos Energy Navigation

Tsakos has a mixed crude/product tanker fleet of 61 ships on the water (+21 newbuildings with deliveries between 2025 and 2028), with an average age of 11.3 years. The fleet is composed by 3 VLCCs, 12 Suezmaxes (+2 newbuildings), 27 Aframaxes/LR2s, 9 LR1s (+5 newbuildings), 2 MRs under construction, 4 Handysize product tankers, 2 LNG carriers and 4 Suezmax shuttle tankers (+12 newbuuildings).

Tsakos’ VLCCs have an average age of 7.7 years, the Suezmaxes of 13.3 years, the Aframaxes/LR2s of 9.2, the LR1s of 15.6 years, the Handysizes of 18.2 years, the LNG carriers of 6.2 years and the Suzemax shuttle tankers of 9.0 years.

Around 47% of the fleet has an Eco design and 20% is scrubber-fitted.

Looking at Q2 ‘25 estimates, we expect Tsakos to record EPS of ca. $1.30, well above Street analysts at $0.71.

Despite a considerable orderbook of 21 newbuildings, we expect the company to continue prioritising fleet expansion vs dividends (currently $1.50 annualised).

Wrapping Things Up

Other than Tsakos, our projections are generally not too far away from analysts’ estimates.

In 1H ‘25 crude tankers have clearly outperformed all other shipping sectors, on the back of considerable optimism from analysts (and investors) around sanctions, Iran, OPEC, scrapping, etc. We believe that 2H will be the “moment of truth”, i.e. for crude tanker equities to deliver on these high expectations.

We’re still very early in Q3 and we believe that there might be opportunities for decent entry opportunities before the (expected) seasonal ramp up in freight rates. With the end of summer, we should see those additional OPEC barrels hitting the water and this might provide the “needed spark” for crude tankers.

Great preview as usual!! I have one suggestion though... I noticed that the earnings sensitivities are calculated only up 70k/day. I think a lot of people would appreciate if you could stretch that to 200k or even 500k :D Just kidding mate, it's great!

Nice summary.