We may have a beneficial long position in some of the shares mentioned via stock ownership, options, or other derivatives.

This presentation expresses the opinion of the author and is provided for informational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities.

The material is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations.

Data as of 31st December 2024.

As we enter into 2025 we thought it would be interesting to look at shipping equities’ performance in 2024, and how they “look” from a valuation perspective.

Stock price action, especially since October, has been brutal and many shipping names are close to their 52 weeks lows.

But is this the right time to go all-in?

Let’s first start by looking at 2024 performance. Despite all the uncertainties, around economic growth, inflation and interest rates, US indexes are at all time highs, with the Nasdaq 100 up almost 25% on the year.

As a comparison, shipping equities’ performance YTD is as follows (equal weight index of 34 stocks we follow):

Dry Bulk: -16.8%

Product Tankers: -19.3%

Crude Tankers: -24.5%

LPG Tankers: -25.4%

Containerships: +22.8%

Share price performance of shipping equities has clearly been underwhelming, especially in Q4, with many names recording new 52 week lows (with the exception of containerships).

Even if we look at total returns (which include dividend payments, given that many shipping equities pay big dividends), performance has been sub-optimal:

Dry Bulk: -6.8%

Product Tankers: -11.9%

Crude Tankers: -15.7%

LPG Tankers: -4.5%

Containerships: +35.2%

We have excluded LPG and containership stocks from the below analysis as we believe that the dynamics of these two segments are slightly different from Dry Bulk and Tankers.

Asset Values Update

Since 2021-22, investors have been “spoiled” by (i) increasing rates on one side (due to Covid disruptions first and geopolitical events after that), which brought abnormal cash flows and dividends and by (ii) increasing asset values.

These two factors together, constantly pushed NAVs higher and, with that, equities’ prices.

Having said this, where do we stand today on asset values? Let’s have a deeper look.

Above is a table which shows where asset prices stand vs the historical average since 2008. As can be seen, Crude and Product Tankers’ values are considerably up vs historical averages, especially on vintage tonnage (exacerbated by sales to the dark fleet).

Even if we just look at modern tonnage, we can see how values are 40-50% higher than historical averages.

Looking at Dry Bulk values, we can see how assets are 20-30% higher than historical averages, although if we focus on just Capesizes, the increase in values is closer to that of tankers.

If we look at the same table, but focusing just on the last 6 months, we can see how vessel values have been under pressure (especially for older tonnage), with values falling an average of 0-5% for resales, 5-10% for modern tonnage (5-10yrs old) and 15-20% for 15yrs old vessels; this has been valid for all sectors given that rates have been underwhelming for both dry bulk and tankers.

Nevertheless, despite the recent drop, asset values are still up, on average, in 2024 (more on this below).

In this respect, let’s analyse how earnings and TC rates have done in the past few years.

As can be seen, according to Clarksons data, Spot rates for all crude tankers peaked in 2023, softening in 2024; for product tankers, on the other hand, 2024 averages were higher vs 2023 (mainly due to the Red Sea disruption, which affected this sector more than crude).

Looking at 1yr TC rates though, we can see how current TCs are 20-30% lower than 2024 averages, and this drop has been concentrated in the past few months, due to rather underwhelming spot markets (with the exception of Afras, to a certain extent).

Usually 1yr TC rates are a leading indicator for asset values and, given the recent drop, we would expect downward pressure on values.

A similar consideration can be made for the dry bulk sector. 2024 was a good year (especially for Capes), but Q4 failed to live up to expectations, with the BCI currently below $10,000/day.

As such, current 1yr TC rates are ca. 20% lower vs the avg. TC rate for 2024, while asset values have “just” started to decrease (they are still above one year ago levels).

A final consideration on asset values is to look at the implied valuation multiple of ships. Let’s have a look at the below tables, based on a generic 5 year old vessel (for each segment).

As can be seen, in order to get to an implied 5x EV/EBITDA multiple at current asset prices, vessels would need to earn historically high rates (i.e. $70k for VLCCs, ca. $50k for Suezmaxes and Aframaxes/LR2s, $40k for LR1s and ca. $35k for MRs).

If we look at current 1yr TC rates, the implied EV/EBITDA valuation is, for all segments (crude and product tankers), at ca. 7.5-8.5x, which we view as high.

Unless there’s a pick up in freight rates, we believe that a 10-20% downside in asset prices is a real possibility, as it would bring valuations to more reasonable levels.

Looking at the dry bulk sector, the same considerations can be made, although the delta between implied valuation and current 1yr TC rates is even more extreme, with all segments trading at 15-20x EV/EBITDA.

This is clearly not sustainable in the longer term and, again, we believe the downside risk on asset values is a real possibility (although we note that current rates may also be a bit of an overreaction).

Equities’ Valuation Update and Sensitivity

In this section we will quickly analyse equities by looking at various valuation metrics like NAV, EV/Fwd. EBITDA, P/Fwd E, Lev. FCF Yields and Fwd. Dividend Yield.

Given that the majority of the above metrics are forward looking, these have been based on various freight assumptions (which reflect our views) and actual numbers might look different.

For Q4 ’24, we have used company guidance + the above assumptions for “open days”.

Please note that the above assumptions are for non-eco/non-scrubber vessels.

NAVs and P/NAV

Dry Bulk - NAV and Sensitivity Analysis

Starting with Dry Bulk, we can see how, from a P/NAV perspective, the sector trades at 0.62 P/NAV (Mkt. Cap weighted average), with the majority of names currently trading below their historical average P/NAV (with the exception of 2020 Bulkers, Belships and United Maritime).

Nevertheless, this is due to the fact that, despite falling earnings, asset prices have remained high (as described in the previous section). If we believe there is downside in vessel values, the current discount might only be “on paper”.

As highlighted in the previous section, asset prices are at historically high levels and, given the current weakness in rates, we believe that values will continue to face some downward pressure.

Should we assume a 10-20% decrease in asset values, we can see how P/NAVs will all be at or above the historical P/NAV averages for each company.

As such we are cautious on “buying the dip” because companies trade at a big discount to NAVs.

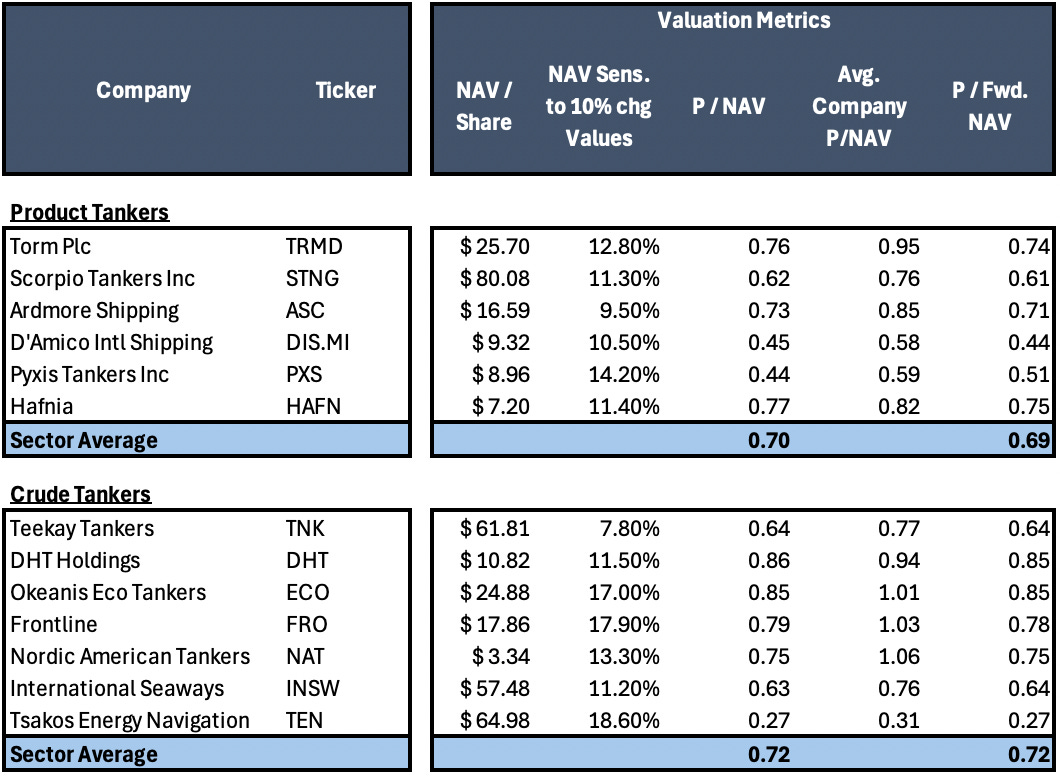

Tankers - NAV and Sensitivity Analysis

Moving on to tankers, very similar considerations can be made. After a dreadful 2 months months for equities, all companies trade below each respective historical average P/NAV, with Product and Crude Tankers trading at 0.70 and 0.72 P/NAV, respectively.

Again, as we said for Dry Bulk, a 10-20% decrease in asset values would bring valuations in line or above historical P/NAV levels and, as such, we are cautious on the sector.

Cash Flow/Earnings Metrics

Despite the recent drop in equity prices, from an earnings/cash flow perspective, a lot of names still look quite expensive. Let’s look at this in more detail.

Dry Bulk - Cash Flow/Earnings Metrics and Sensitivity Analysis

Starting from Dry Bulk, we can see how the average EV/Fwd. EBITDA multiple is ca. 8x, with only 2 companies trading below 6x (i.e. Genco and Eurodry).

At the other end of the spectrum is Golden Ocean and Himalaya, which are both trading at or above 10x.

Looking at Lev. FCF Yield, we can see how Genco, Safe Bulkers and 2020 Bulkers are the only companies expected to generate FCF yields at or above 10% (vs a sector average of just 4.3%).

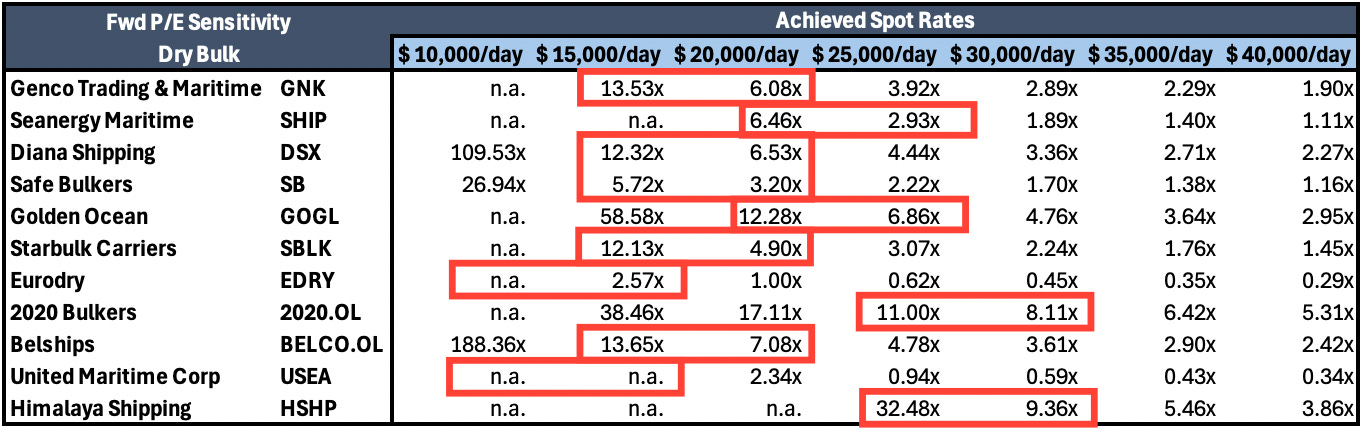

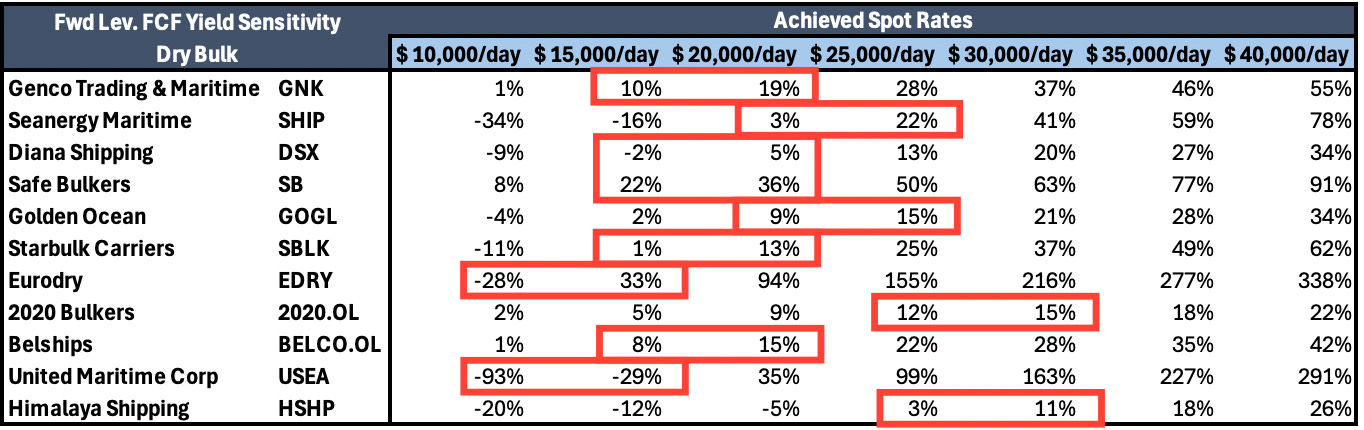

In the below tables we show the sensitivity of each company P/E and Lev. FCF Yield to various TCE levels (achieved spot rates).

Starting from the Fwd P/E, we have highlighted in red what we believe are the most probable range of achieved TCEs, based on today’s rates assumptions (for the next 12m) and based on each company fleet profile.

As can be seen, the lower end of our expectations would produce rather high P/E (above 10x, with the exception of Seanergy and Safe Bulkers), while, on the other hand, the higher end of our expectations would provide some attractive entry points, especially for Seanergy, Safe Bulkers, Eurodry and Starbulk.

Moving on to Lev. FCF Yield sensitivity, at the lower end of expectations, only Genco, Safe Bulkers and 2020 Bulkers, would produce double digit FCFs, while using the higher end of expectations, the picture gets more interesting with few companies having FCFs >20% (Seanergy, Safe Bulkers, Eurodry).

One last consideration to make is that FCF is different from return of capital to shareholders (as seasoned shipping investors know) and as such, management quality and other considerations should be made.

In general, we can see how Fwd P/Es and Lev. FCFs are very sensitive to $5,000 change in daily freight rates and, although we’re cautious on the sector, a sudden movement in rates or an exogenous factor (more on this in the next section), could create good opportunities for investors in 2025.

Tankers - Cash Flow/Earnings Metrics and Sensitivity Analysis

Looking at tankers, the “story” is similar; all companies still look rather expensive on an EV/Fwd EBITDA basis, with only Tsakos and Teekay Tankers trading at or below 5x for Crude Tankers, and Torm, Ardmore and D’Amico for Product Tankers.

If we consider the Lev. FCF Yield, we can see how product tankers look better than crude, with the average Lev. FCF Yield being 12.4% vs 8.9%.

The issue, in our view, is not that rates are/will be bad for tankers on an “absolute” level, but that valuations are still high and based on high TCE assumptions, with which we disagree.

As an example, above the 2025 assumptions from Pareto on Product and Crude Tankers.

In the below tables we show the sensitivity of each company P/E and Lev. FCF Yield to various TCE levels (achieved spot rates).

As for Dry Bulk, we have highlighted in red what we believe are the most probable ranges of achieved TCEs, based on today’s rates assumptions (for the next 12m) and based on each company fleet profile.

Looking at the above table, what immediately comes to light, in our view, is that crude tankers (and especially VLCC-heavy companies) seem richly priced vs smaller vessels (i.e. Suez/Afra and Product Tankers).

Even at $50,000 achieved spot rates, DHT, Frontline and Okeanis would trade all >6x Fwd P/E.

Looking at the downside, if rates somewhat disappoint, we can see how the lower end of the ranges show high P/E ratios especially for crude tankers.

For Product Tankers, ratios seem more attractive, although the sector might be more at risk to external factors (as explained in the next section).

Similar considerations can be made by looking at Lev. FCF Yields; In general yields for product tankers look more interesting than crude tankers, although at the lower end of the range, they still look expensive (with the exception of D’Amico/Hafnia).

Again, what is highlighted by the above is that, as for P/E, VLCC-heavy companies look richly priced unless we expect very high rates in 2025.

As for Dry Bulk, FCF is different from return of capital to shareholders and as such, management quality and other considerations should be made.

Potential Risks and Opportunities to Equities in 2025

If freight markets rebound from here, this will have been proven as an attractive entry point to invest in shipping, with many equities at or very close to 52-week lows.

On the other hand, this should be weighted against potential risks. Our general view is that the odds of more downside have increased in the last year, while the upside in equities (bar an “exogenous” event like a war, etc.) are somewhat capped.

Below we will try to list some of the risks/opportunities we see going into 2025 (listed in no specific order).

The below is not an exhaustive list and we are just expressing our personal views.

Risks

Extension of OPEC+ Voluntary Cuts - Tankers

On December 5th, OPEC+ met and, as widely expected, they further extended the 2.2mbd voluntary cuts by 3 months; unless there is a further delay, the 2.2mbd barrels will be re-introduced into the market over an 18-month period instead of the planned 12 months.

What was, in our view, not expected and is not fully priced in tanker equities, is the extension of the collective cuts from end-2025 to end-2026. This, effectively delays any hope of a VLCC/tanker supercycle by a further year, with the only uncertainty being Trump’s stance on Iran, which may reshuffle the “base case” (more on this later).

Given how confusing is OPEC+ messaging, and in order to make things a bit more clear, below a recap of the existing OPEC+ cuts (pre and post meeting). There are 3 “layers” of OPEC+ cuts:

1. Collective 2mbd cuts: these cuts were supposed to be reversed at end-2025; they’ve now been extended by 1 year to end-2026.

2. Voluntary 2.7mbd cuts: these voluntary cuts were agreed to last until end-2025, but they’ve also now been extended to end-2026.

3. Voluntary 2.2mbd cuts by 8 countries: these are what the medias refer to when they talk about the “voluntary cuts”. These barrels were initially supposed to be returned in October 2024, but this has now been postponed to end Q1'25 (and given 1. and 2. There is a high chance, in our view, that they will be rolled over into Q2 2025, at least).

According to a recent Tankers International presentation the voluntary cuts (i.e. 3. above) are “removing” from the market demand for ca. 50-55 VLCC-equivalent, which, if we assume a global fleet of ca. 900 vessels, represents a 5-6% demand reduction (we’re simplifying a bit things, but clearly the impact is not negligible).

OPEC also advised that the assessment period for production capacities of members will be extended to November 2026, so we shouldn’t expect new “allocations” until then.

We don’t see how crude tankers rates can increase substantially, without the reversal of OPEC cuts (which are, by the way, caused primarily by disappointing crude oil demand growth and are not just a consequence of non-OPEC supply growth). No OPEC, No Party.

Red Sea Disruption - All Sectors

Without going into much detail, the Red Sea/Suez Canal has been effectively closed to commercial shipping for almost a year now. This has obviously benefitted shipping as whole, as the “alternative” route around the Cape of Good Hope is much longer.

The sectors most affected by this have been containerships, car carriers and, to a lesser extent, Product Tankers.

In 2024 the US completed some airstrikes against the Houthi, but this was clearly not enough to deter/stop them from targeting ships transiting the Red Sea.

Nevertheless, we believe that during the past months the “geopolitical equilibrium” of the area has changed, with Iran “losing” ground. As we know, Iran is the main sponsor of the Houthi and of other terrorist organisations/governments in the Middle East (Hamas, Hezbollah, Assad regime). All these have been, over time, abandoned by the Tehran regime and it remains to be seen if the Houthi will continue to receive the same amount of support as they did.

Israeli airstrikes in Yemen against the Houthi are intensifying and the situation is escalating with the Houthi having recently fired a hypersonic missile into Israel. In parallel, Iran has “abandoned” its proxies in Palestine, Lebanon and most recently Syria.

As such, the question is if Iran has the willingness to continue supporting the Houthi or not (given also the growing internal issues of the Islamic Republic, with an intensifying energy crisis, etc). Should they reduce their support, we believe that the Houthi might be more condescending and agreeable to sit to the negotiating table in exchange for some sort “international recognition”.

Despite being (still) a remote possibility, we believe that the odds of a partial reopening of the Red Sea to commercial shipping have increased vs the beginning of the year.

This would affect all sectors, although Containers, Car Carriers and Product Tankers would suffer the most (being the sectors that have benefitted more by this disruption, in the first place).

Ukraine-Russia War - Crude and Product Tankers

We’ve seen recent news about an “opening” to negotiations by Putin, in relation to a potential ceasefire/end of war in Ukraine. Clearly this won’t be a smooth process, but with Trump as new president and his promise to swiftly end all conflicts, we believe (again) that odds of a peace deal are increasing.

A peace deal is different from a removal of sanctions (which would affect shipping), but it would be a “first step”.

In the short term nothing would change, but we believe that equities would react negatively to this “change in sentiment”, both for a potential Ukraine-Russia peace deal and for the Red Sea disruption.

Trump Presidency - All Sectors

If Trump sticks to his plan of increasing tariffs on Chinese imports (and also European, Canadian, Mexican), this will create a trade war which would slowdown GDP growth (not good for shipping overall), and create potential trade inefficiencies (counter tariffs on US agri/gas exports), with negative effects on shipping demand.

In relation to Trump’s stance on Iran, if sanctions on Iran are implemented and are effective (the latter is a big if), they could potentially be very positive for crude tankers, pushing more barrels onto the compliant fleet.

Growing Orderbook - Tankers and Dry Bulk

Starting from Tankers, according to Clarksons’ data, only VLCCs have an order book below 10% (9% to be precise), with Suezmax at 16.6%, Aframax/LR2 at 19.6%, LR1s at 15.4% and MRs at 15.2%.

In terms of delivery schedules, in 2025 Suezmaxes, Afra/LR2s and MRs will see around 4.5-5% fleet growth (assuming no scrapping).

One thing to note, especially looking at VLCCs and Suezmaxes, is that, usually, on their maiden voyages (and sometime for the next few), these vessels transport clean products East-West, cannibalising what usually would have been LR2 cargoes.

Given that the delivery schedule in the last 2 years was quite low, LRs have not seen this, but from 2025, this phenomenon could put even more pressure on LR rates.

Looking at Dry Bulk, the order book for Capes/Newcastlemax is attractive at just 7.3%, with Kamsarmax/Panamax at 13.8% and Ultra/Supramax at 12%.

In terms of delivery schedule, assuming no scrapping, the fleet growth in 2025 will be equal to 1.9% for Capes/Newcastlemax, 4.2% for Kamsarmax/Panamax and 4.9% for Ultra/Supramax.

China - Tankers and Dry Bulk

Without going into much detail, we believe that data from China is “tricky” and, given its importance for shipping, it could represent a risk.

Starting from Tankers, and looking at demand forecasts, Sinopec expects Chinese crude demand to peak by 2027 at ca. 16MMbpd; these forecasts (as all forecasts) need to be taken with a pinch of salt, but interesting that one of the top Chinese refiners is expecting peak demand so close in time.

This is mainly due to various factors, such as the increasing penetration of EVs, the switch from diesel to LNG for trucking, reduced construction activity, just to name a few.

Moving to Dry Bulk, below some interesting data from the World Steel Association. China steel production in November 2024 was +2.5% vs last year, but if we look at the Jan-Nov 2024 period, production is down 2.7%. On the other hand India production rose 5.9%.

As we can see, China accounts for more than half of the global steel production and, as such, developments in China are key for dry bulk and particularly for the capesize segment.

With iron ore inventories at very high levels (i.e. 150m tons) and weak steel demand/prospects, we see de-stocking as a potential risk to the dry bulk/capesize investment thesis.

Without a strong government stimulus in 2025 (to be focused towards the manufacturing, infrastructure, RE sectors), shipping demand from China could be underwhelming.

Unfortunately, as of today, it seem that stimulus measures have not been sufficient and, anyway, they should be concentrated more towards stimulating internal consumption vs new investments.

Opportunities

Trump Presidency and Stance on Iran - Crude Tankers

In addition to having promised to end wars in the Middle East and Russia on day one Trump has hinted (through potential nominations, etc) that he will toughen the US stance on Iran.

During his previous term as president he introduced heavy sanctions on the country and the “base case” is that he will have a similar stance also this time. Taken at face value this is clearly a positive for crude tankers, as it could reduce the ability for Iran to export crude (the largest buyer, by far, of Iranian crude is China).

Should sanctions be effective, we believe that there is a potential for the Iranian “lost” barrels to be replaced by the Saudi (also given that one of the pledges of the new US administration is to keep oil prices under control) and, this, would be a net positive for the compliant fleet and VLCCs especially.

Nevertheless, compared to the last Trump presidency, the impact on tankers might be more limited this time, given that in the past years the sanctioned trade grew exponentially and Iran/Russia built an effective “network” of companies, insurance covers, etc, in order to trade “outside” the USD world.

As such, it could be more difficult for sanctions authorities to effectively limit the sanctioned/Iranian trade this time.

Another factor to consider on Iran is any potential escalation/intervention by Israel, which could disrupt oil production/export facilities in the country.

Simandou - Dry Bulk

According to Rio Tinto website, Simandou will be “the largest greenfield integrated mine and infrastructure investment in Africa” and it “will allow the export of up to 120 million tonnes per year of mined iron ore”.

First production from the mine is expected in the second half of 2025, ramping up over 30 months, which according to Clarksons will create additional demand for ca. 100 Capes.

Summarising the bullish case:

Tonmiles: Guinea-China (where most of the Iron Ore is expected to be transported to), is further away vs Australia and similar to Brazil-China; as such tonmiles will increase substantially.

Guinea-China 11,500 nautical miles

Australia-China 5,000 nautical miles

Brazil China 10,000 nautical miles

Iron Ore Quality: Simandou iron ore will be high quality with avg. Fe content expected at ca. 65-66% and, thus, China will replace domestic low-quality iron ore with high-quality imported one; this would increase seaborne imports of iron ore.

As we know, sell side reports always tend to paint the best case scenario. What we need also to consider is that:

Simandou will replace not only some Australian exports but also Brazilian ones, so the net tonmile effect will be slightly lower.

In addition to this, China is a price sensitive buyer and, as such, it might be not straightforward that they will just replace cheap domestic low-quality iron ore with more expensive imported one.

Finally, higher Fe content, means that a lower amount of iron ore is needed to produce the same amount of steel, and this would have a negative effect on imported iron ore volumes.

Simandou iron ore has a 65-66%, ca. 10% higher than Australian iron ore (59% Fe content on average).

As such, although positive, the net effect on Capesize demand could be less than what analysts are expecting.

The fact that the list of risks is longer than that of opportunities doesn’t mean that there won’t be opportunities in shipping equities in 2025.

We actually believe that there might be some very good opportunities for outsized returns this year.

The point is to correctly weigh these risks and invest accordingly. Prices are reaching interesting levels and we believe that they might get even more in the coming weeks.

Wrapping Things Up

In our view, the key points of the above analysis are that we are entering 2025 with equities having corrected substantially in 2H ’24 and approaching interesting levels.

Nevertheless, we also believe that risks have increased vs a year ago, with:

Asset values at historically very high levels, while, on the other hand, rates have corrected; as such, there is a disconnect between the two.

Despite the correction, equities prices still reflect bullish freight assumptions for 2025.

Increasing orderbooks pose a “threat” to the investment thesis, although they’re not at “crazy” levels.

The odds of a normalisation of various geopolitical events which benefitted shipping in the past years, have increased.

OPEC actions and China weakness pose a threat to shipping.

Obviously this analysis is just expressing our opinion and, at the end, it depends on your fundamental view of the markets.

As a final consideration, the period 2021-2024 can be considered as the "NAV appreciation trade", where NAVs of all sectors increased substantially due to rising asset prices.

This has worked perfectly, as external factors also pushed freight rates up (Covid congestion and reopening, Russia-Ukraine war, Red Sea disruption, etc); as such, asset prices and freight rates moved up in tandem, pushing up equity prices.

However, going into 2024 we’ve see how one leg of the equation has disappointed (i.e. rates) and we believe that the “NAV appreciation trade” has ended/is ending.

For 2025, we believe that it will be all about FCF and returns to shareholders (i.e. management quality).

In the coming weeks, we will start publishing our Q4 Earnings Previews.

does that take into account some inflation, or do you expect prices to be unchanged into infinity?

"Above is a table which shows where asset prices stand vs the historical average since 2008. As can be seen, Crude and Product Tankers’ values are considerably up vs historical averages, especially on vintage tonnage (exacerbated by sales to the dark fleet)"

tks for ur writings, but on the panamax and kamsarmax 2022/2023/2024,average spot daily rates, i check the baltic exchange summary which is different from urs (from clarkson data?)

2024 2023 2022

180K 5tc 22,593 16,389 16,177

82k 5tc 14,099 12,854 20,736

76k 4tc 12,763 11,518 20,600

i stand with baltic exchange data, hope it is helpful to u